FERC Institutionalizes DR

From the December 2008 issue of EEnergy Informer.

With the strike of a pen, DR is put on par with supply side options

Demand response (DR) is like the weather. Everybody likes to talk about it but nobody does anything about it. Up to now, that has been the case in the power industry and among the system operators who run organized US wholesale markets. DR has been getting plenty of lip service but is rarely on an equal footing with supply-side resources.

That changed in mid October 2008 when, without much fanfare, the Federal Energy Regulatory Commission (FERC) finalized new rules intended to strengthen the operation and improve the competitiveness of organized US wholesale electric markets. By adopting the ideas introduced in Notice of Proposed Rulemaking (NOPR), originally issued in Feb 2008, FERC intends to increase the use of DR, encourage long-term power contracts, strengthen the role of market monitors and enhance the responsiveness of regional transmission organizations (RTOs) and independent system operators (ISOs).

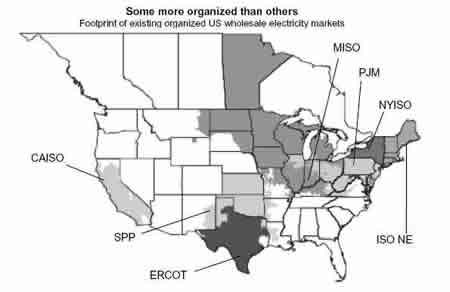

The FERC order applies to existing US organized wholesale markets, PJM Interconnection, LLC (PJM); New York Independent System Operator, Inc. (NYISO); Midwest Independent Transmission System Operator, Inc. (MISO); ISO New England, Inc. (ISONE); California Independent System Operator Corp. (CAISO); and Southwest Power Pool (SPP) – and any new ones that emerge in the future. Over half of existing US installed capacity will be affected (see table below).

In announcing the new rules, FERC Chairman Joseph T. Kelliher said, “Competition is national policy and it is FERC’s duty to foster competition and adopt those policies that will improve the operation of wholesale power markets and benefit consumers,” adding. “This … is one in a series of reforms FERC has taken to promote competition in wholesale power markets. As markets emerge and other opportunities arise, FERC will continue to evaluate its rules to ensure that the nation’s wholesale power customers have effective competition, a strong market structure and the just and reasonable rates that they deserve.”

The commission said that it believes effective wholesale competition protects consumers by providing more supply options, encouraging new entry and innovation, spurring development of new technologies, promoting demand response and energy efficiency, and improving operating performance of market participants. If it sounds like apple pie and baseball, it is.

Beyond the generalities, the order directs existing RTOs and ISOs to adopt or implement the following:

- Take immediate steps to expand the role of demand response;

- Make it easier for market participants to engage in longterm power contracting, specifically requiring each RTO and ISO to dedicate a portion of its web site for market participants to post offers to buy or sell power on a long-term basis;

- Strengthening the independence of market monitoring function by requiring the market monitoring unit (MMU) to report to the board, rather than to the management; and

- Encouraging markets to become more responsive to customers and stakeholders by providing effective access to the RTO or ISO board of directors.

The new rules pertinent to DR are particularly noteworthy, requiring RTOs and ISOs to:

- Accept bids in markets for ancillary services from technically capable DR resources as it currently does for supply-side resources;

- Eliminate certain charges to buyers in the energy market for voluntarily reducing demand during a system emergency;

- Permit an aggregator of retail DR to bid the combined negative load directly into an RTO’s or ISO’s organized markets;

- Allow the market price to more accurately reflect the value of energy during periods of operating reserve shortages; and

- Assess and report on any remaining barriers to comparable treatment of DR in organized markets.

In short, FERC would like to see DR treated on par with supply-side options, recognizing its full value in meeting system loads while introducing an element of price elasticity into organized markets. It remains to be seen how successful this new order will be, but the intent is clear.

Each RTO or ISO must comply within six months. “We recognize and respect the differences across various regions. At the same time, wholesale competition can serve customers well in all regions,” the Commission said.

One Response to 'FERC Institutionalizes DR'

Leave a Reply

You must be logged in to post a comment.

on November 26th, 2008 at 9:39 pm

[…] FERC Institutionalizes DR […]